How to Buy Things with Bitcoin - Part 1

Can you buy a loaf of bread or a coffee with Bitcoin? The answer is 'yes', and here are your options.

One of the most common criticisms of Bitcoin is that it has no real use case. I even had a viewer comment recently: “Good luck trying to buy a loaf of bread with Bitcoin.”

So let’s unpack that. Can you actually buy bread with Bitcoin today? Yes you can, but how you do it - and how convenient it is - depends on which payment method you choose.

Before we get into the payment options, it’s worth taking a step back and asking: what are the functions of money, and does Bitcoin fulfill these?

The Functions of Money

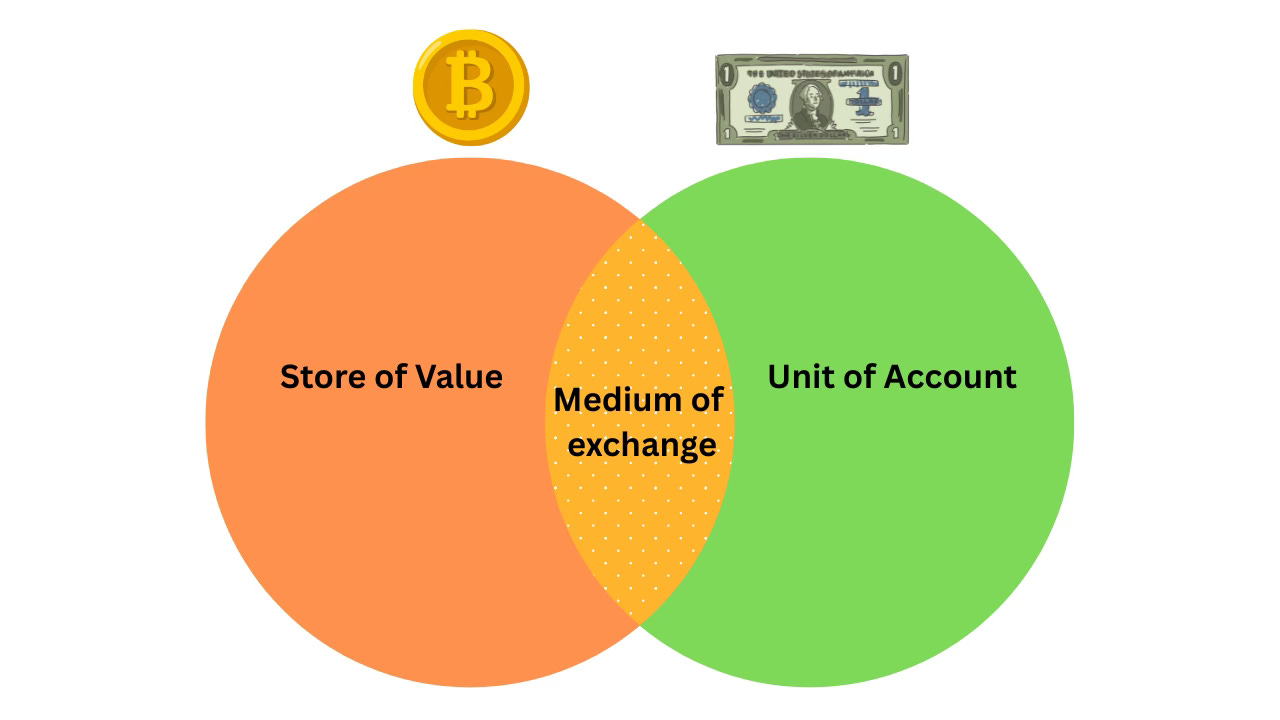

Classical economists such as Adam Smith outlined three main functions of money:

Store of value – money must hold its worth over time.

Medium of exchange – it must be usable in transactions.

Unit of account – prices must be denominated in it.

This is one view of the functions of money - other theories have somewhat differing views.

Modern Monetary Theory sees money primarily as a unit of account defined and enforced by the state. Money as a medium of transaction extends from that.

Austrian economics, on the other hand, emphasizes that money must first succeed as a store of value before it can function as a medium of exchange or unit of account.

BTC vs USD as Money

Let’s test the US dollar - the world’s reserve currency, against these three functions.

❌ As a store of value, fiat is terrible. Inflation eats it away constantly, which is why people try to swap their cash for assets like property, shares, or gold.

✅ As a medium of exchange, the USD reign supreme - it is probably the most widely accepted currency in the world.

✅ As a unit of account, the USD also dominates. Almost everything we buy or measure is denominated in fiat currency.

Now, compare that with Bitcoin.

✅ As a store of value, Bitcoin excels. That’s why it’s often called “digital gold.”

✅ As a medium of exchange, Bitcoin is just starting to gain traction. It works, but it’s not yet widely accepted.

❌ As a unit of account, it isn’t there yet. We don’t measure the price of groceries, flights, or salaries in sats — at least not yet. Bitcoin will need to be much more common as a medium of exchange before it will be considered to be a unit of account.

This is where critics get stuck. They focus only on the ‘medium of exchange’ and ‘unit of account’ functions, and ignore that Bitcoin is already being used worldwide as money, primarily through its store of value function.

Using Bitcoin Doesn’t Always Mean Spending It

When people talk about ‘using Bitcoin,’ they usually mean spending it on goods and services. But that’s only one way to use money.

Simply holding Bitcoin as a store of value is also using it. That might sound strange because fiat money has trained us to believe the opposite.

With dollars or euros, holding them is a losing game — inflation guarantees that your money buys less each year. That’s why we instinctively think ‘use money = spend money.’

But with Bitcoin, holding is the most powerful way to use it today. You’re preserving value across time, something fiat can’t do.

However, increasingly Bitcoin is becoming more common as a medium of exchange. And this is where the crossover with the USD and other major currencies is happening.

Bitcoin can now be used alongside fiat currencies as a medium of exchange - albeit in a far more limited capacity.

So How Do You Actually Pay Using Bitcoin?

Let’s come back to that loaf of bread. If you want to pay for it with Bitcoin today, you generally have three choices:

On-chain transactions (Layer 1)

Custodial debit cards

Lightning Network (Layer 2)

Each has its pros and cons, and the right choice depends on the situation.

1. On-Chain Transactions

This is the original method. Every transaction is settled directly on the Bitcoin blockchain.

Think of it like a SWIFT wire transfer: it’s reliable, secure, and final. That makes it perfect for large, important purchases — things like buying a car, paying for land, or moving Bitcoin into cold storage.

But for small, everyday payments? It doesn’t make sense. On-chain transactions can take 10 minutes or more to confirm, and fees might cost more than that loaf of bread you’re trying to buy.

Pros: secure, censorship-resistant, final settlement.

Cons: slow, expensive, impractical for small items.

This is what critics usually mean when they say something like ‘you can’t buy a loaf of bread with Bitcoin.’ And they’re right, because on-chain is not designed for that.

2. Custodial Debit Cards

The second option is a Bitcoin/crypto debit card that automatically converts BTC into fiat at the checkout. I use one from Bybit that connects to Apple Pay, and it works just like any other card.

From the merchant’s perspective, they’re simply being paid in the local currency. Behind the scenes, my Bitcoin is sold at the going rate and the equivalent amount of fiat is delivered to the vendor.

This does make everyday spending easy. A bitcoin/crypto debit card makes a very convenient off-ramp. I’ve used it for groceries, restaurants, even flights.

But it’s important to understand what’s happening: you’re not really paying in Bitcoin. You’re selling Bitcoin for fiat in real time.

That raises two issues:

It’s custodial. You’re trusting the exchange to hold your coins. I only keep a small balance there — enough for monthly spending but not enough to lose sleep over.

In many countries, it’s also a taxable event. Each time you spend, you’re technically disposing of Bitcoin, which may trigger capital gains tax.

You’re not actually transacting in Bitcoin which means it’s not contributing to Bitcoin adoption in any way.

So debit cards are convenient, but they’re not true Bitcoin payments. They’re a bridge to the fiat system.

3. Lightning Network

The most exciting and promising option is the Lightning Network, Bitcoin’s layer 2 payment system. It takes the best of both worlds and combines them into one payment system.

Think of Lightning like Visa for Bitcoin. It sits on top of the base chain, allowing instant, low-cost transactions that settle later.

In the same way that you can make fast, easy transactions with a credit card and then settle all transactions at a later date, Lightning allow you to transact off the base layer, and those transaction are settled on-chain at a later time.

With Lightning, I can open a wallet on my phone, scan a QR code, and pay in seconds for a fraction of a cent. No KYC, no waiting and no custodian in the middle if I choose a self-custody wallet.

This makes Lightning perfect for small everyday purchases — a coffee, a loaf of bread, or even micro-transactions online, like a small tip.

It’s also growing fast in parts of the world where people are locked out of the banking system or dealing with hyperinflation. All they need is a phone and an internet connection.

I highly recommend checking out Joe Nakamoto’s latest video for a real look at Lightning in action in one of the poorest parts of the world. It shows how Bitcoin can leapfrog the traditional banking system entirely.

Pros: instant, cheap, works for very small payments, self-custody possible.

Cons: not all merchants accept it yet, large transactions can fail due to liquidity limitations.

This is the option that most closely answers the ‘bread’ critique. It’s not hypothetical. It already works and is being used for many different purposes around the world.

How I Personally Use Bitcoin

I use all three methods, depending on the situation.

For large, important purchases, I’ve used on-chain transactions. For example, I paid for my Start9 server directly in Bitcoin.

For small tips or payments between individuals, I use Lightning. While merchants near me don’t yet accept it, I do receive Lightning tips online.

For everyday spending like groceries, restaurants, or flights, I often use my ByBit debit card. It’s the easiest off-ramp in a world where most vendors still don’t accept Bitcoin directly.

Each option has its place. In an ideal world I wouldn’t need to have an off-ramp option like the ByBit card, but until more vendors start accepting Bitcoin payments - and especially lightning payments - it is a convenient bridge.

Where We Are Today

So let’s compare Bitcoin and the US dollar:

US dollar: a great medium of exchange and unit of account, but a terrible store of value. And once money fails at storing value, it eventually fails as a medium of exchange and unit of account, too. Think of hyperinflated currencies - eventually nobody wants to accept it as a form of payment anymore.

Bitcoin: an excellent store of value, an emerging medium of exchange (especially with Lightning), and can become a unit of account when it is more widely accepted as a transactional currency.

That last step may sound far away, but it’s not impossible. Imagine a world where goods are priced directly in sats, not dollars. That shift would signal Bitcoin’s full maturity as money.

So How About That Bread?

So, back to my viewer and their comment: ‘Good luck buying a loaf of bread with Bitcoin.’

Bitcoin’s best answer to that problem is the lightning network, which is fast, cheap, and already working in communities all over the world.

It can side-step centralized systems and allow for small, non-KYC transactions to take place anywhere these is a phone and internet connection.

Bitcoin isn’t just an investment. It’s hard money. Right now, its strongest role is as a store of value, but its utility as a medium of exchange is growing every day.

And one day, when Bitcoin becomes widely accepted, it can also serve as a unit of account.

In Part 2 of this series, I’ll explain the Lightning Network in plain language and walk through how to actually make a payment using different wallets.

💬 But for now, I’d love to hear from you: where you live, do local merchants accept Bitcoin payments? Are you using the Lightning network yet?

My Trusted Bitcoin Partners

If you are looking to buy or sell Bitcoin, I use and recommend Caleb & Brown. They offer personalized service and if you need a bit of guidance or hand-holding through the process, you can deal directly with your personal broker. They charge a flat fee and there are no hidden costs or spreads that you will find on most exchanges. Minimum buy/sell is $500.

As a client of The Bitcoin Way I can confidently recommend their services to anyone serious about securing their Bitcoin. Their team guides you step by step through setting up and maintaining the highest standard of self-custody, giving you peace of mind that your Bitcoin is safe. Use the link to book a free 30 minute consultation with them.

I am a referral partner of Caleb & Brown and The Bitcoin Way, so I receive a small commission if you become their client.

Caleb & Brown unfortunately cannot accept UK or New York-based clients.

I’m all set up with a lightning wallet ready to go. Just need some merchants to offer payment by lightning 👍🏻. There’s nothing at all in my area by the looks of it 🤷♂️

Great insight, hanging out for Pt 2